Explainer: East coast gas price rises

MCJ Posted on

MCJ Posted on  Monday, February 17, 2014 at 21:45

Monday, February 17, 2014 at 21:45 Retail gas prices in New South Wales are regulated by the Independent Pricing and Regulatory Tribunal (IPART), and in their currently-running determination for retail gas prices IPART has received proposed price increases of 20% from gas retailers AGL and Origin. Prices in other states are expected to rise by similar amounts. (IPART summary [PDF]; AGL submission [PDF]; Origin submission [PDF].)

A 20% rise in prices over a single year is significant, and unlike electricity price rises in recent years it has little to do with network investment. Here’s what’s going on, from the ground up (if you’ll excuse the pun):

The problem

Wholesale natural gas prices are expected to rise strongly from 2014 onward, leading to higher costs on the eastern seaboard for industrial users (miners and mineral processing facilities, basic chemical and fertiliser manufacturers), households with gas connections, and households served by electricity generated by gas.

Some people have also suggested that NSW may be unable to import enough gas on days of high demand during winter, as gas from its traditional sellers in Queensland is diverted to Gladstone and the pipelines from Victoria aren’t able to deliver enough gas to replace it. Many gas observers reckon this is bunk: NSW should be able to supply itself with gas – even on peak demand days – so long as it is willing to pay the appropriate price.

Why is this happening?

The east coast of Australia doesn’t have, and hasn’t until this year had, any capability to export significant quantities of natural gas. WA and the NT have export capacity, but the gas network linking the eastern states (plus SA and Tassie) doesn’t join either of their networks.

From 2014, this will change. Queensland has three large projects to export gas becoming operational in 2014 and 2015, all on Curtis Island in Gladstone, south of Rockhampton. The facilities to export gas are called ‘trains’, and involve piping the gas to the factory to be cooled into a liquid – liquefied natural gas, LNG – so it can be stored on a ship and transported overseas.

The reasons this changes domestic prices (Australian prices) are: 1) that foreigners are willing to pay a lot more for gas than we are; and 2) foreign demand is so great, and we’ll be able to export so much, that the international price will essentially set the domestic price.

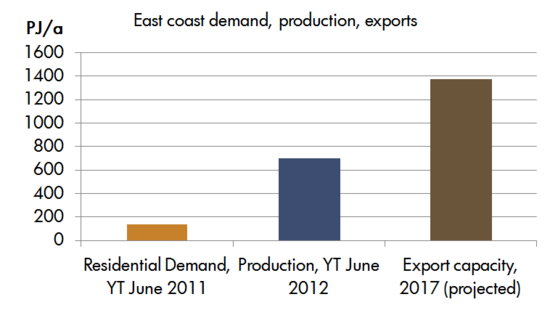

To put some figures on that: east coast residential consumption of gas (directly) is a little less than 20% of total domestic demand, and the export capacity of all three LNG trains is projected to be around 200% of current domestic demand.

Source: CUAC (2013) Making the Gas Connection, p.17Clearly, this export capacity isn’t being built without the expectation that there’ll be more gas available to export than is currently being produced, and that’s where ‘unconventional’ gas comes in.

Source: CUAC (2013) Making the Gas Connection, p.17Clearly, this export capacity isn’t being built without the expectation that there’ll be more gas available to export than is currently being produced, and that’s where ‘unconventional’ gas comes in.

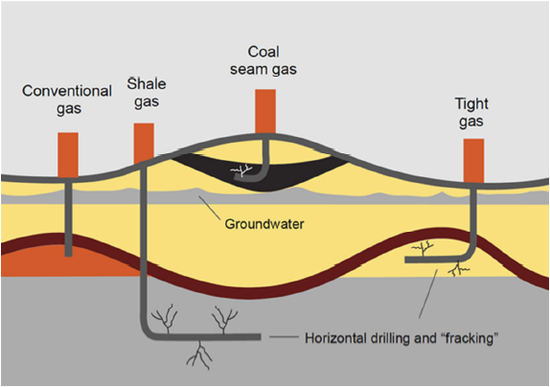

Grattan (2013) Getting Gas Right: Australia’s Energy Challenge, p.7The vast majority of gas produced in Australia historically, and even the great majority produced today, is from ‘conventional’ deposits. These deposits are reservoirs of low-density, permeable rock with an impermeable layer on top. Think of permeable rock as having lots of little chambers or holes that are linked to each other. Once that top layer is drilled through, conventional gas can be retrieved reasonably simply, since everything is connected.

Grattan (2013) Getting Gas Right: Australia’s Energy Challenge, p.7The vast majority of gas produced in Australia historically, and even the great majority produced today, is from ‘conventional’ deposits. These deposits are reservoirs of low-density, permeable rock with an impermeable layer on top. Think of permeable rock as having lots of little chambers or holes that are linked to each other. Once that top layer is drilled through, conventional gas can be retrieved reasonably simply, since everything is connected.

Unconventional gas deposits are in different types of rock that require more effort to extract gas from. Put simply, the rock is less permeable: rather than existing in lots of chambers that are linked to each other, the chambers are separate. In order to connect them, the drilling doesn’t just go down, it goes across. Drillers also drill far more wells than for unconventional gas, and ‘break’ the rock to let the gas flow between chambers through the fractures. That fracturing process is what’s known as “fracking”. Unconventional gas is often not found as “just” gas, but instead mixed with e.g. water sitting along seams of coal. It therefore requires additional processing to extract, and the wastewater needs to be disposed of.

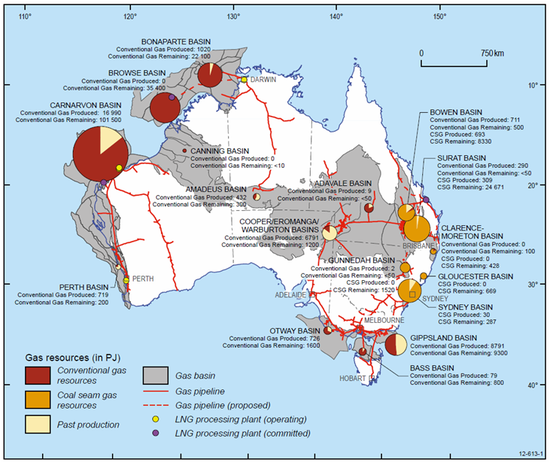

Queensland and NSW have quite a lot of unconventional gas, in particular coal seam gas (CSG); far more than they do conventional gas.  Source: Geoscience Australia and BREE (2012) Australian Gas Resource Assessment 2012, p. 2Neither Victoria, South Australia, nor Tasmania really have any CSG. There might be deposits of CSG or other unconventional gas (shale gas; tight gas) there, but at the moment there’s no serious suggestion that these are commercially viable. If anything is discovered, it would typically take around five years to bring it to market.

Source: Geoscience Australia and BREE (2012) Australian Gas Resource Assessment 2012, p. 2Neither Victoria, South Australia, nor Tasmania really have any CSG. There might be deposits of CSG or other unconventional gas (shale gas; tight gas) there, but at the moment there’s no serious suggestion that these are commercially viable. If anything is discovered, it would typically take around five years to bring it to market.

Queensland has taken the lead on CSG development, while NSW is still figuring out which way it will go. Victoria has recently decided to conduct a year and a half of consultation, and I’m not sure what SA and Tassie are doing.

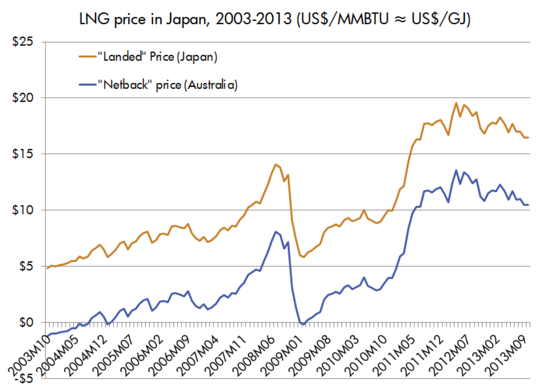

So: Queensland is building export capacity, and plans to sell CSG to Asia for ~$15/GJ.  Source: www.imf.orgLess the costs of transportation, conversion, etc that gives them a price at the factory gate of ~$9/GJ; the “netback” price. If you’re a producer with conventional gas fields, you want to get in on the action too, of course. Why would you keep selling to Australians at $3-$6/GJ when you can get two to three times as much selling to the Japanese or Koreans?

Source: www.imf.orgLess the costs of transportation, conversion, etc that gives them a price at the factory gate of ~$9/GJ; the “netback” price. If you’re a producer with conventional gas fields, you want to get in on the action too, of course. Why would you keep selling to Australians at $3-$6/GJ when you can get two to three times as much selling to the Japanese or Koreans?

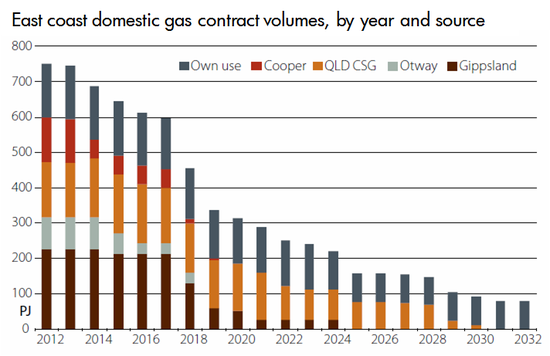

Source: BREE (2012) Gas Market Report., p. 50Of course you wouldn’t, so when the long-term contracts that have historically characterised the eastern gas market expire, the price of the new contracts will depend on what the international outlook is. That one of the things adding uncertainty to the gas sector at the moment, and causing bellyaches amongst all the industries that use lots of gas. An AIG survey [PDF] earlier this year claimed only one-third of companies trying to get new gas contracts faced a competitive market with multiple serious offers.

Source: BREE (2012) Gas Market Report., p. 50Of course you wouldn’t, so when the long-term contracts that have historically characterised the eastern gas market expire, the price of the new contracts will depend on what the international outlook is. That one of the things adding uncertainty to the gas sector at the moment, and causing bellyaches amongst all the industries that use lots of gas. An AIG survey [PDF] earlier this year claimed only one-third of companies trying to get new gas contracts faced a competitive market with multiple serious offers.

How big will the problem be?

Of the increase in wholesale gas prices, how much will flow to households?

There are three channels through which increased wholesale prices could flow through to consumers. The first is if they purchase products from gas-intensive industries: mineral products, chemicals, fertilisers mainly. This channel probably might be significant, but it’s outside my scope.

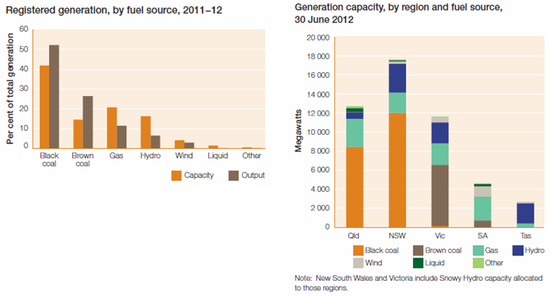

The second channel is purchasing electricity that generated by gas. I haven’t found any estimates of how big that effect will be, and I don’t know enough to model it on the back of an envelope. As of last year, gas-fired power generation accounted for 21% of capacity in the NEM, but supplied only 11% of the output.

Source: AER (2012) State of the Energy Market 2012, p.32Gas generation capacity as a proportion of total capacity varies greatly by state, with South Australia the most reliant, and I expect the effects will also differ based on what type of turbine is used and whether they’re baseload or peaking. A quick search didn’t turn up any calculations, but it’s an interesting technical exercise and I’m sure someone has done or will do it. My intuition is that the effect won’t be all that large, as the power sector is one in which gas is most readily substituteable for other fuels. (See, e.g. Stanwell in Queensland shutting their gas power plant, re-starting their coal plant, and selling the gas.)

Source: AER (2012) State of the Energy Market 2012, p.32Gas generation capacity as a proportion of total capacity varies greatly by state, with South Australia the most reliant, and I expect the effects will also differ based on what type of turbine is used and whether they’re baseload or peaking. A quick search didn’t turn up any calculations, but it’s an interesting technical exercise and I’m sure someone has done or will do it. My intuition is that the effect won’t be all that large, as the power sector is one in which gas is most readily substituteable for other fuels. (See, e.g. Stanwell in Queensland shutting their gas power plant, re-starting their coal plant, and selling the gas.)

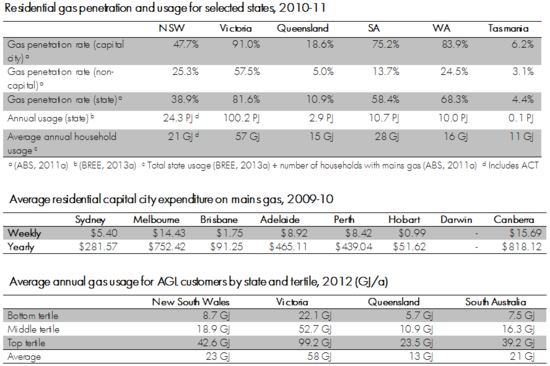

The third channel is direct gas usage in the home, for cooking, water heating, and space heating. Source: CUAC (2013) Making the Gas Connection, pp.8-9From these tables we can get an idea of how many people in each state use gas, how much they use on average, and what it costs them. Keep in mind that there is a wide range of usage patterns, both within and between states: New South Welsh use twice as much gas as Queenslanders, and Victorians twice more again. Meanwhile, high-usage households use five times as much gas as low-usage households.

Source: CUAC (2013) Making the Gas Connection, pp.8-9From these tables we can get an idea of how many people in each state use gas, how much they use on average, and what it costs them. Keep in mind that there is a wide range of usage patterns, both within and between states: New South Welsh use twice as much gas as Queenslanders, and Victorians twice more again. Meanwhile, high-usage households use five times as much gas as low-usage households.

Costs

Now we get to the pointy end: how much is the bill increase going to be?

As of last year, my mid-range estimate was that wholesale costs make up 20-25% of the retail price, and that these wholesale costs double in the next 5 years. Fully passed through, that’s a retail price increase of 20-25%. As it happens, that fits in quite well with the retailers in NSW are proposing.

Taking the expenditure from 2010 as a baseline, that increases average annual Sydney bills by $70, Melbourne by $190, Brisbane by $23, Adelaide and Perth $110-115, $10 in Hobart, and over $200 in Canberra.

That was my ballpark estimate, but it’s pretty close to what the Grattan Institute (Getting Gas Right [PDF], p.7) and the Victorian Gas Taskforce report [PDF] (p. 18) estimate. IPART suggests typical NSW bills will increase by $169-$239 in the next year (p.3 of their summary).

For an average household, $100-200 per year probably isn’t that much. But for disadvantaged and vulnerable groups – especially those in the top third of users, who may have double the average usage – those are significant increases.

What can be done?

Well, there’s not much we can do about the export growth. That’s locked in. There are several people calling for a domestic reserve of gas, that is, limiting exports. There are strong economic arguments against domestic reserves and trade restrictions, basically because they’re inefficient: the loss to producers from decreased exports is less than the gain to consumers through lower prices.

Domestic reserves also aren’t really an option for the near future, since slapping an export restriction on existing projects would be a legal and public relations nightmare, and new projects take around five years before gas hits the market.

However, putting a domestic reserve on new projects is something the manufacturers and Victorian Labor have suggested, and there are plenty of people from all sides of politics interested in expanding supply.

The problem is that we’ve already developed most of the cheap gas out there; new gas is all more expensive. It’s cheaper than what Asia will pay, sure, but more expensive than what Australians are used to paying.

I’ve also mentioned that export capacity will be twice as big as domestic demand and willing to pay twice as much – as a small economy in a global marketplace we’d need to increase production quite a bit to make a difference. The most likely outcome of increasing supply is that we’ll increase our exports.

There you go: that’s gas.

Gas

Gas

Reader Comments